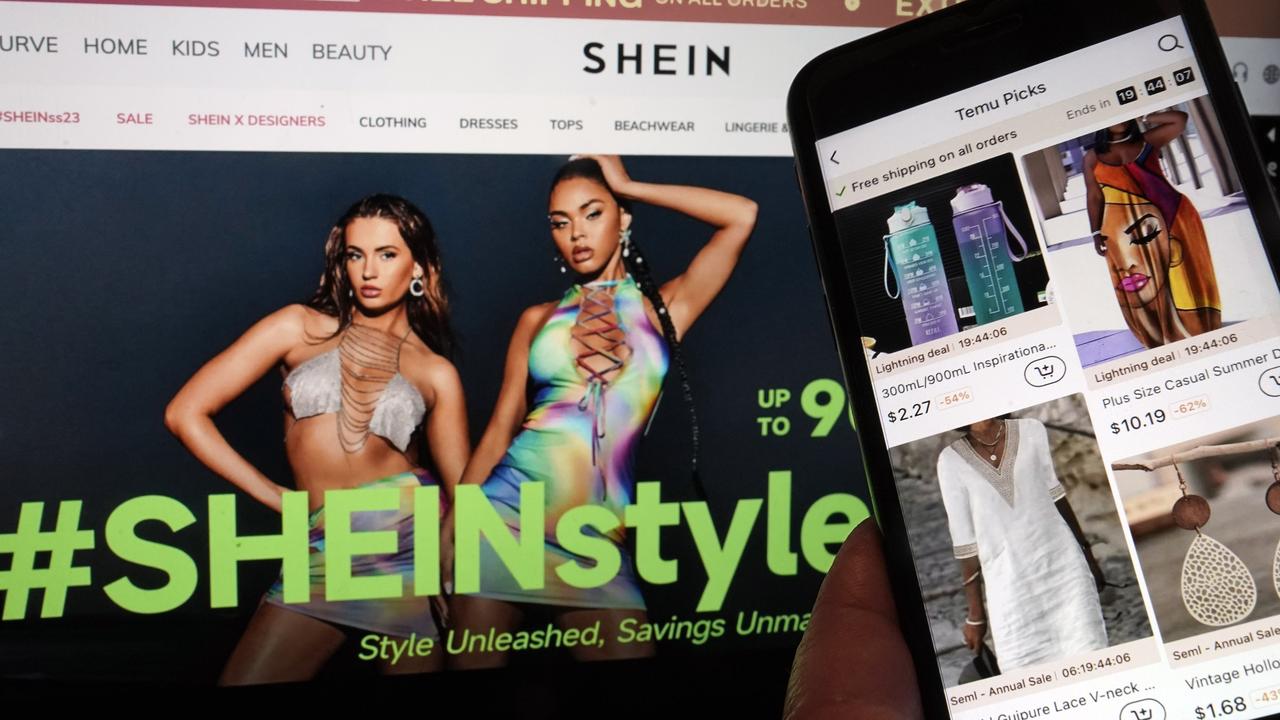

Subscription traps and dangerous products bought on marketplaces like Shein and Temu are in the crosshairs of a new digital focus for consumer protection.

The consumer watchdog will lay out its priorities for the upcoming financial year on Thursday, with online retailers to come under increased scrutiny.

The regulator is widening its focus to digital marketplaces after a year of heavy scrutiny on supermarket giants, including an ongoing court case against Coles for misleading pricing.

Businesses and consumers are being constantly bombarded with opaque marketing and junk items online, says the chair of the Australian Competition and Consumer Commission.

“We’re very concerned to see the proliferation of unsafe products in online marketplaces,” Gina Cass-Gottlieb said.

Forcing the marketplace giants to sign up to a product safety pledge is one of the reforms being pushed.

Only AliExpress, Amazon and eBay have signed up to the ACCC’s voluntary pledge to co-operate on product safety.

Breaches of that code and the lack of oversight over China-based Temu and Shein was eroding trust among buyers, the ACCC said.

Of particular concern, unsafe baby products including items for sleep and devices containing button batteries are being sold on the giant online marketplaces.

“We don’t feel that we are able to access sufficient data that can properly bear upon product safety concerns,” Ms Cass-Gottlieb said.

Elsewhere in the digital space, the watchdog has its eyes on influencers failing to properly disclose sponsored content.

Consumer bugbears will also be scrutinised including streaming services, gyms and phone providers that set subscription traps and then make it difficult to cancel deals.

The ACCC is conscious of a global atmosphere of declining trust in governments and regulators.

“We are seeking to be as clear, engaged (and) accessible about what we’re doing and why,” Ms Cass-Gottlieb said.

“We are asking business no more than what we are asking ourselves – they must be accountable to meet the standards.”

Cracking down on scams has proved troublesome as Meta frustrates the regulator with four years of delays and dismissal applications in a key lawsuit.

Meta was sued by the ACCC in March 2022 for failing to remove scams on its platforms, including Facebook and Instagram.

But the watchdog has achieved several high-profile penalties in recent months.

Health insurance giant Bupa was ordered in December to pay $35 million for misleading customers about benefits.

In September, embattled telco Optus was forced to pay $100 million in fines for targeting vulnerable customers with phone plans they could not afford.