Australians spent big on Black Friday sales and concerts, driving household spending to the highest annual level in more than two years.

Household spending rose one per cent in November, which means the figure was 6.3 per cent higher than the same time a year prior, the Australian Bureau of Statistics revealed on Monday.

That’s the highest yearly growth rate since September 2023.

The figures point to continued strength in the nation’s economic recovery; more evidence for the Reserve Bank of Australia that the economy does not need further monetary stimulus.

The result was higher than expectations, with the forecaster consensus predicting growth of 0.6 per cent.

Ahead of the release, NAB’s economics team said in a research note a key focus would be whether October’s broad-based lift in spending was sustained.

Spending growth was broad-based in November, with eight of the nine spending categories rising, ABS head of business statistics Tom Lay said.

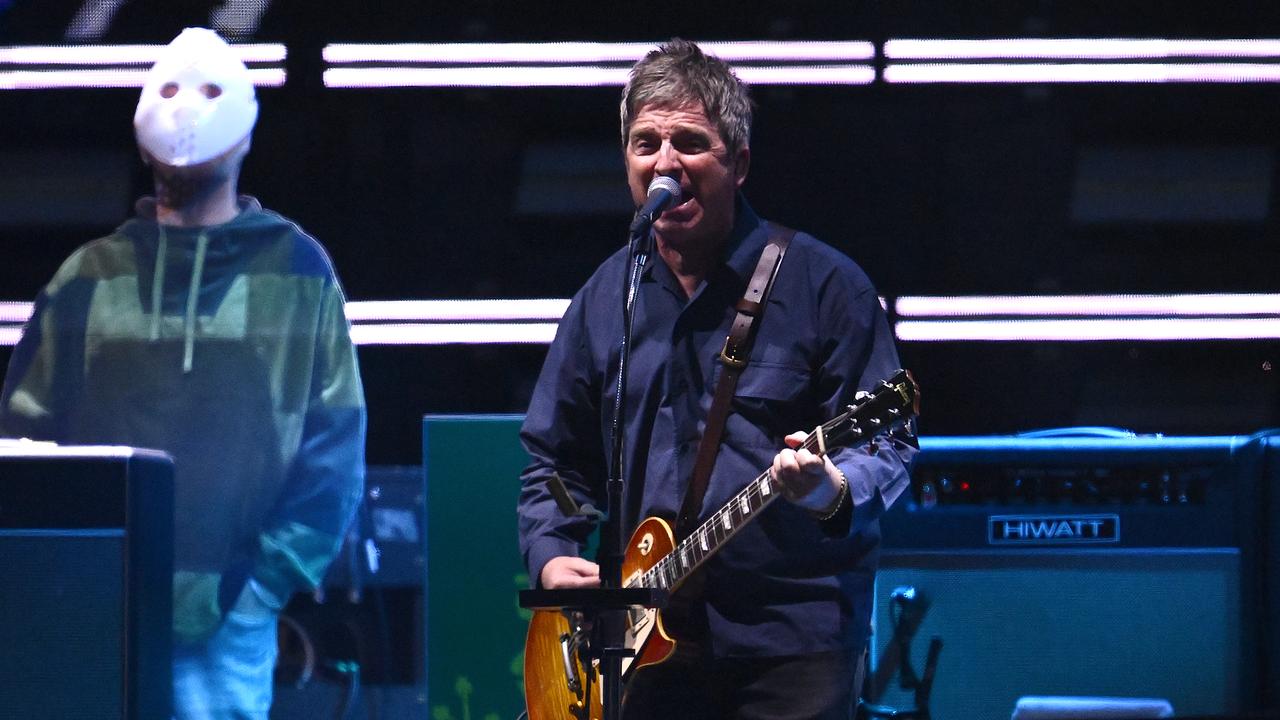

“Services spending rose by 1.2 per cent, driven by major events, including concerts and sporting fixtures. These events are linked to higher spending on catering, transport, and recreation and cultural activities,” he said.

“Growth in goods spending, which lifted 0.9 per cent, was driven by Black Friday sales. Clothing, footwear, furnishings, and electronics seeing the biggest gains as consumers took advantage of widespread discounts.”

Britpop giants Oasis played sold-out stadium shows in Melbourne and Sydney during the month and record crowds turned out to the opening Ashes Test in Perth, although attendances would have been higher had it run for more than two days.

The biggest rise was in furnishings and household equipment, up 2.2 per cent, while spending on clothing and footwear was two per cent higher and recreation and culture jumped 1.7 per cent.

Every state and territory recorded growth of at least 0.5 per cent, with Tasmania experiencing the biggest lift of 2.1 per cent.

Discretionary spending rose 1.2 per cent for the month, outpacing spending on essentials which climbed 0.7 per cent.

The outlook for spending remained strong for people who owned their homes outright, head of economic research and global trade for Oxford Economics Australia Harry Murphy Cruise said

But mortgage holders and renters faced tighter budgets and weaker confidence, he said.

“That will see steady, but unspectacular, aggregate spending growth through this year.”