The Reserve Bank will shine new light on why it decided to hike interest rates, while fresh data should offer insight into whether a further increase is on the cards.

Minutes from the central bank’s last meeting in early February, where it unanimously decided to kick up interest rates 25 basis points to 3.85 per cent, will be made public on Tuesday.

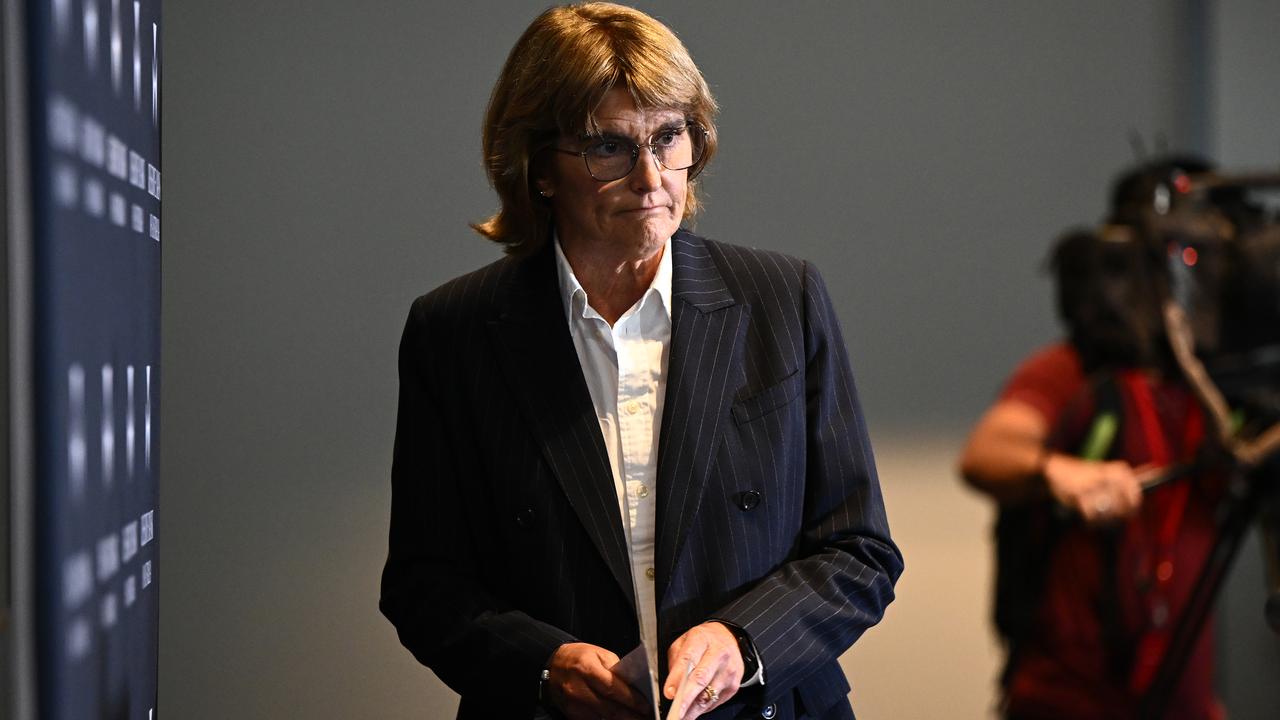

While governor Michelle Bullock has fronted press conferences and two federal parliamentary hearings on the rate call, the minutes are expected to reveal the factors that led to the decision.

Ms Bullock has previously said a resurgence in inflation forced the bank’s hand, with the speed of consumer spending and business investment catching the RBA’s board off guard.

Looking ahead, figures from the Australian Bureau of Statistics will help fill in more of the picture for the central bank for future rate calls.

Wednesday will reveal wage data for the final quarter of 2025.

NAB senior economist Taylor Nugent said wage growth was largely expected to come in at 3.4 per cent year-on-year, which would be in line with forecasts from the Reserve Bank.

He said a boost in wages in services professions would likely see a 0.8 per cent rise for the quarter.

“There will be a boost of around five basis points from the October tranche of pay rises related to the work value case for aged care workers,” Mr Nugent said.

“Wage price index growth has been supported over the past year by public sector wage agreements that incorporate some catch up growth.”

Thursday will see all-important labour force figures for January released.

After December’s figures saw a drop in unemployment to 4.1 per cent, driven by more 15 to 24-year-olds heading into work, the jobless rate for the start of 2026 is likely to tick up.

Mr Nugent said there would likely be a 20,000-person boost in unemployment, with the rate also growing to 4.2 per cent.

“The past three Januarys have seen a 10-15 basis point rise in the unemployment rate that was partially reversed in February because there have been more people unemployed but attached to a job they are waiting to start than was normal prior to the pandemic,” he said

“After the surprise two-tenths fall in December, it does support the expectation for some reversal in January.”

An encouraging update on inflation has meanwhile helped calm Wall Street investors wracked by worry over how artificial-intelligence technology may upend the business world.

The S&P 500 barely budged on Friday, a day after tumbling to one of its worst losses since Thanksgiving.

The Dow Jones Industrial Average rose 48 points, or 0.1 per cent, and the Nasdaq composite slipped 0.2 per cent.

Australian share futures climbed 26 points, or 0.29 per cent, to 11,215.

The S&P/ASX200 fell 125.9 points on Friday, down 1.39 per cent, to 8,917.6, as the broader All Ordinaries lost 143 points, or 1.54 per cent, to 9,138.8.