The Trump gang’s power to act beyond any laws in disrupting, coercing, stealing and killing comes from America’s economic and military might but the limits to one of those is in sight, writes Michael Pascoe.

The latest act in the Madness of King Donald drama playing globally on every channel underlined the increasingly delusional world the anti-hero inhabits, his fantasies fed and indulged by a cast of sycophants, lackeys and straight grifters, all in it for what they can get.

Like a moustachioed pantomime villain relishing boos and hisses from the audience, Trump is oblivious to warnings and protestations from the sane world and simply contemptuous of the lickspittle mob desperately hoping to go unnoticed.

The draft dodger relies on the USA’s unchallenged military might for much of his swagger but it is America’s economic weight that is his preferred weapon, the threat and reality of tariffs to coerce nations, individual sanctions to attack individuals such as International Criminal Court judges and UN staff who displease him.

Economy reckoning looms

America’s military power is not going away soon. There is a reckoning looming though for its economic might even as its GDP growth outpaces the rest of the west and its stock markets set ever higher records.

The reality is that the US economy is as pumped up as a Trump social media post. Second only to Japan but in worse circumstances, “the Greatest Economy in the History of our Country”, as Trump calls it, is running on fiscal stimulus, the government spending vastly more than it raises in taxes, plus the AI investment bubble for extra sauce to cover the soaring deficit brought to you by the mob who claimed to be cutting spending.

Remember when the Morrison/Frydenberg government threw the fiscal kitchen sink at the Australian economy as COVID hit? The annual budget deficit as a percentage of GDP jumped to 6.5 per cent, the highest since the Second World War. It dropped back to zero, rose to one per cent last financial year and is running at about 1.5 per cent this year with all-commentators-on-deck screaming disaster about it not heading back to zero.

A gigantic US budget deficit

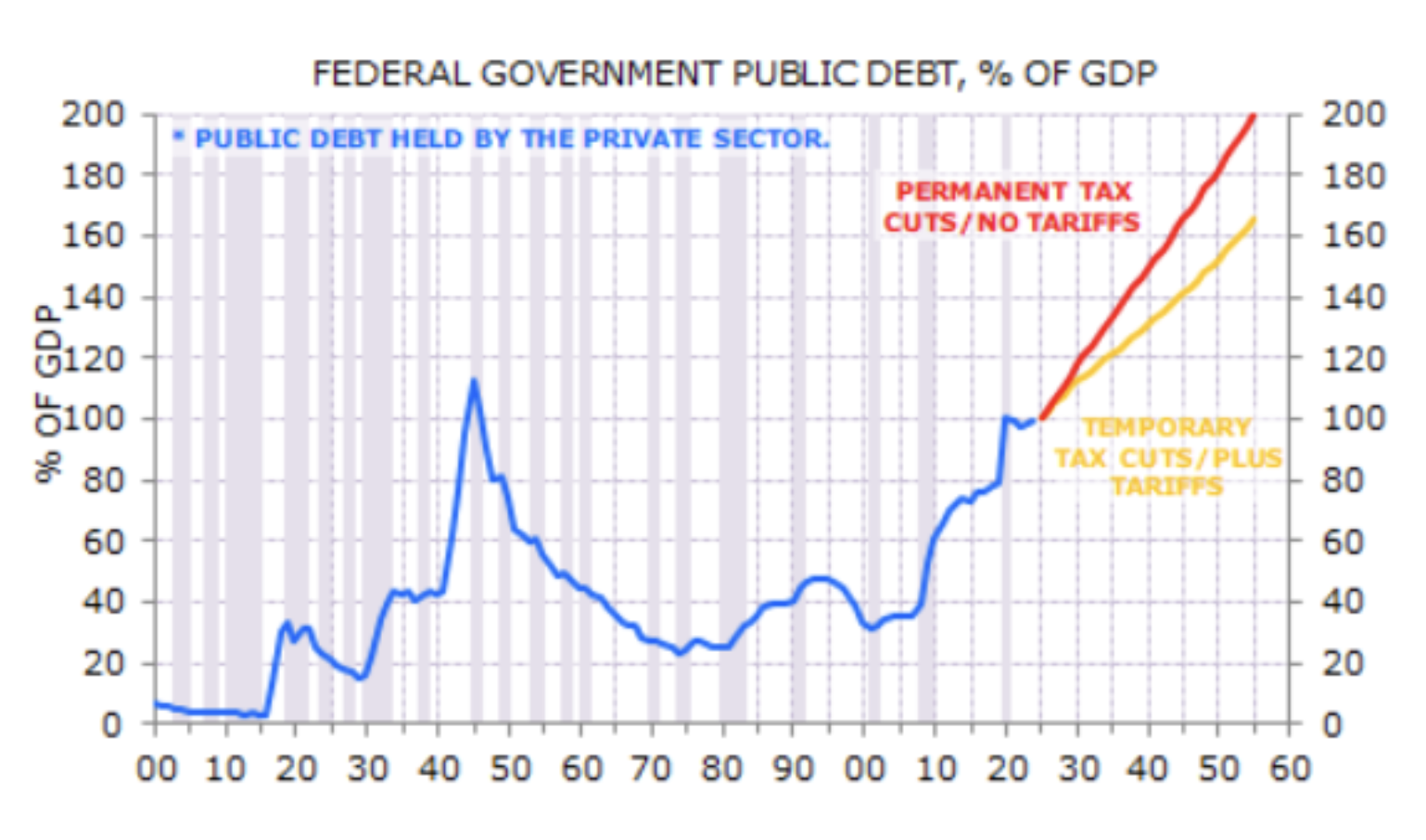

Well, the annual US federal deficit is still running around 6 per cent of GDP and destined to get worse. No, Virginia, the combination of Trump’s tax cuts and tariffs don’t help and, yes, when the AI investment bubble pops GDP growth will drop making the deficit/GDP ratio worse, unless you believe the tech bros hype about AI suddenly delivering universal nirvana.

Over the past four quarters of published data, the US GDP growth annual growth rate was 2.3 per cent and that was after the most recent quarter printed high. Having dug its US$38.5 trillion national debt hole,

the US cannot grow its way out,

especially when it just keeps digging.

Bond market ructions

The bond market tremor over Trump’s Federal Reserve intimidation and going too far with his Greenland odyssey was only wobble but a warning nonetheless that American exceptionalism granted by the power of the greenback does indeed have limits.

There has been plenty written about the US debt mountain, about how the interest burden alone is now running at around 3.2 per cent of GDP so that more than half of every new dollar the US Treasury borrows goes on servicing the debt with no plan or even Trumpian projection to deal with it.

Without the Trump mob destabilising the world and shattering confidence in US government, it is not sustainable.

With the Trump mob, oh dear.

And now the bad news. The US is not alone in having a fiscal crisis on the horizon, it’s just the biggest and therefore most worrying offender.

Sovereign debt crises ahoy

In a note last month to his array of international fund manager clients, Gerard Minack, Morgan Stanley’s former Global Strategist, warned that many developed economies are heading for sovereign debt crises.

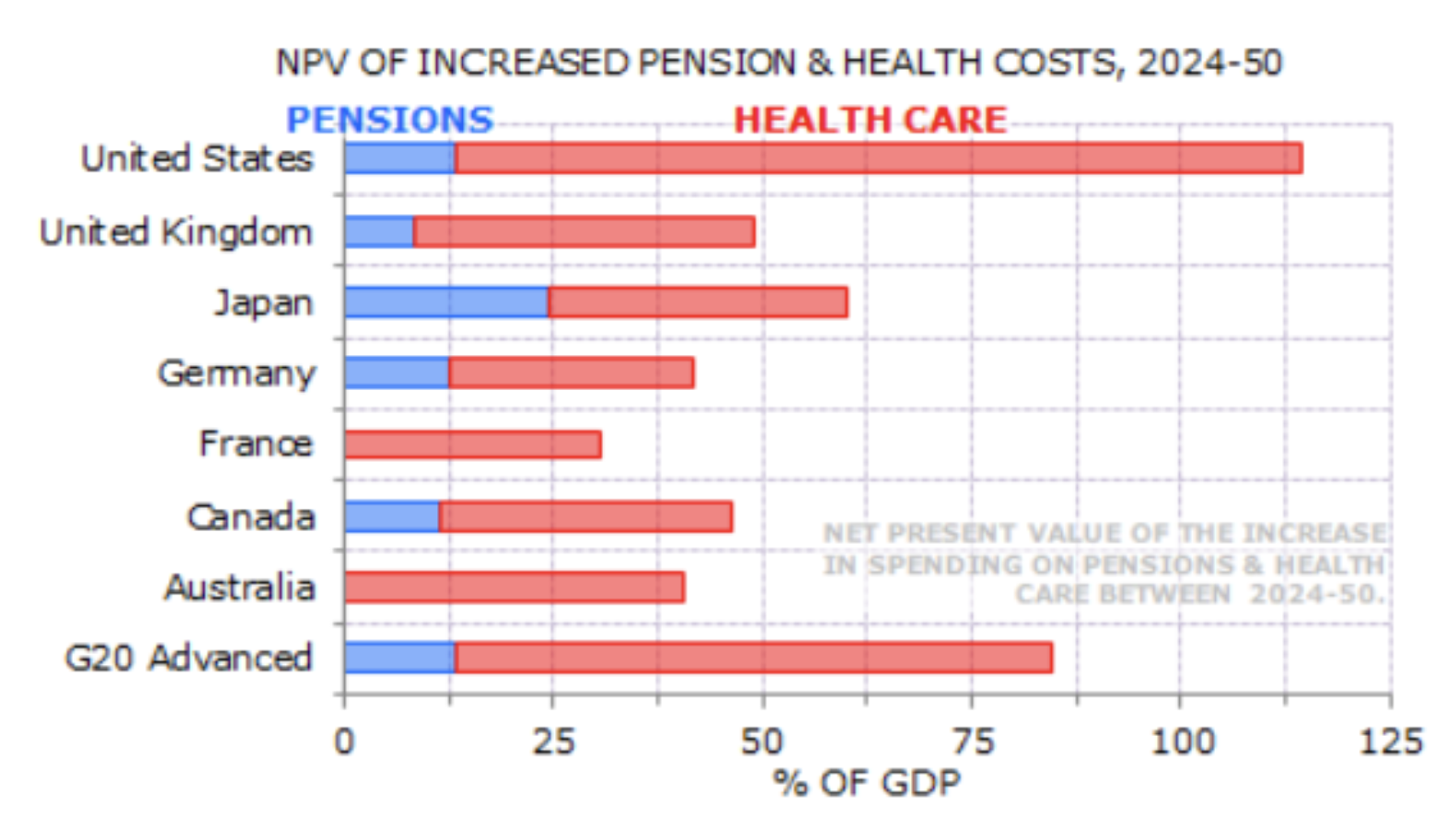

“Debt levels are already high, demographics will add to spending, and rising real rates are worsening debt service,” wrote the founder and CEO of Minack Advisors.

“There seems little appetite amongst political leaders or voters to change course, so a crisis seems just a matter of time, most likely in the next 3 to 5 years. History shows most large fiscal consolidations include a mix of budget restraint and stiffing bond holders.”

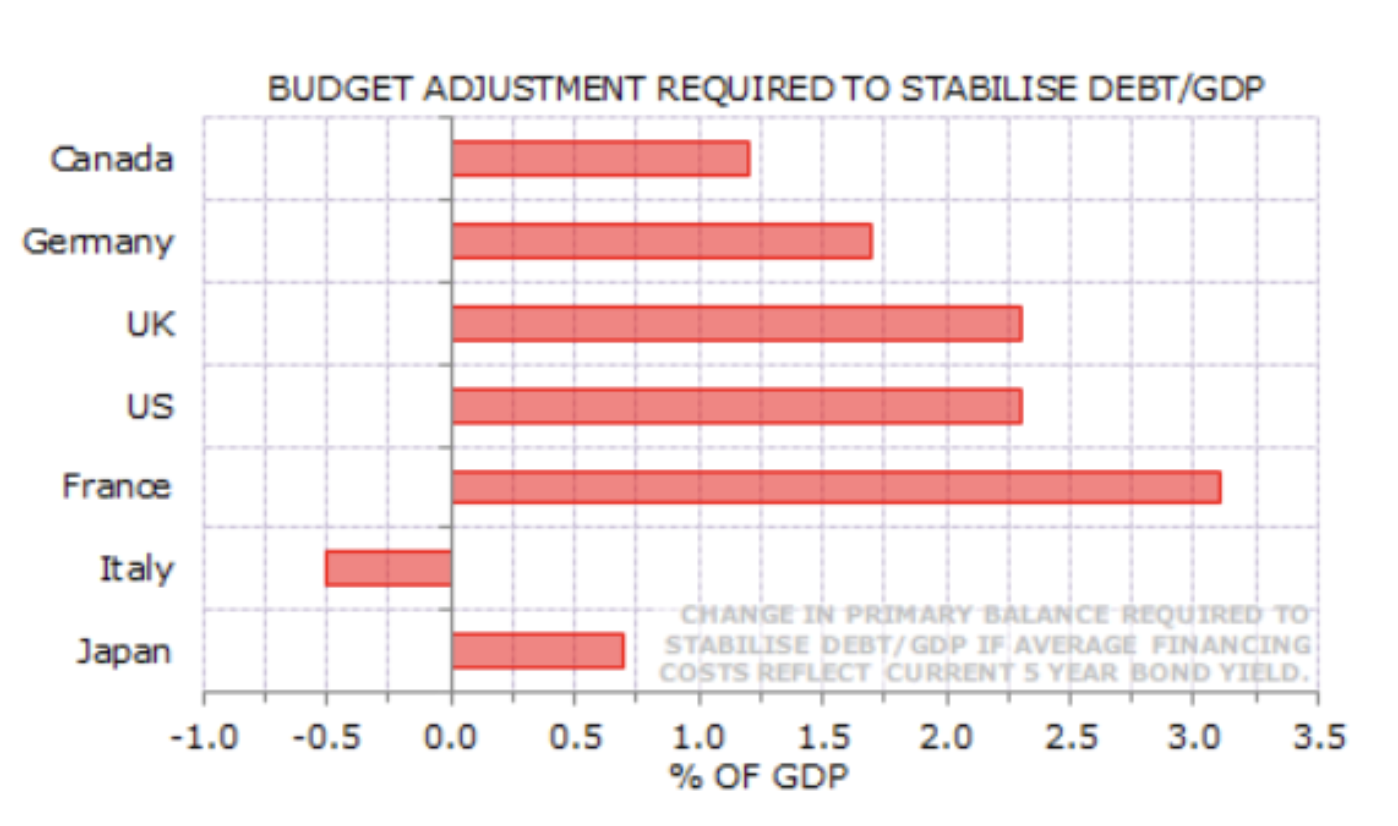

Just to stabilise US debt as a percentage of GDP, Minack estimates the budget deficit would need to be cut by 2.3 per cent.

“The required adjustments are not nothing, but nor are they massive by historical standards, in part because stabilising debt at historically high levels is not an ambitious target. Yet there seems little or no appetite amongst political leaders or voters to stop the digging. Indeed, many populist challengers want to dig faster.”

Cutting spending and/or lifting taxes by 2.3 per cent of GDP, reducing the fiscal stimulus that’s keeping the US humming however discordantly, would be anathema to the populist Trump yet greater cost challenges are locked in.

We’re used to fretting about what our demographics promise to do to health care costs. The US problem is of another magnitude.

US debt, who wants it?

With that promise, who wants to maintain their present levels of US government debt? The trillions of greenbacks have to be parked somewhere and players might think the game is OK for now but Minack also warns that a crisis could emerge at any time, the three-to-five year period is merely what he regards as a certainty.

Considering that outlook is a job for our government as well as individual investors. A fiscal crisis quickly becomes a euphemism for a deep recession, a recession when governments don’t have ammunition to ameliorate the pain. Just ask the Greeks about 2009-2010.

But what follows for us goes beyond economic cycles. The promised fiscal crisis in America would mean cutting the spending that would be least painful to cut.

Australia deputy dawg

Garrisoning the Indo-Pacific, the cost of playing global military master, quickly falls into that category, fulfilling the forecasts of Hugh White and Geoff Raby of American withdrawal, leaving Australia as the discarded and diminished Deputy Dawg looking lonely in our region.

It fits with America’s published national security strategy, the “Donroe Doctrine” of supremacy over the Americas and everyone else for themselves.

Somebody should tell the ever-loyal-to-America Australian Government that the money says such loyalty is destined to be a one-way street.

Rendering an Australian citizen to the corrupt regime of Donald Trump