Santos has loaded its first LNG cargo at its Barossa project as it reports stronger production and revenue results despite weaker commodity prices in the recent quarter.

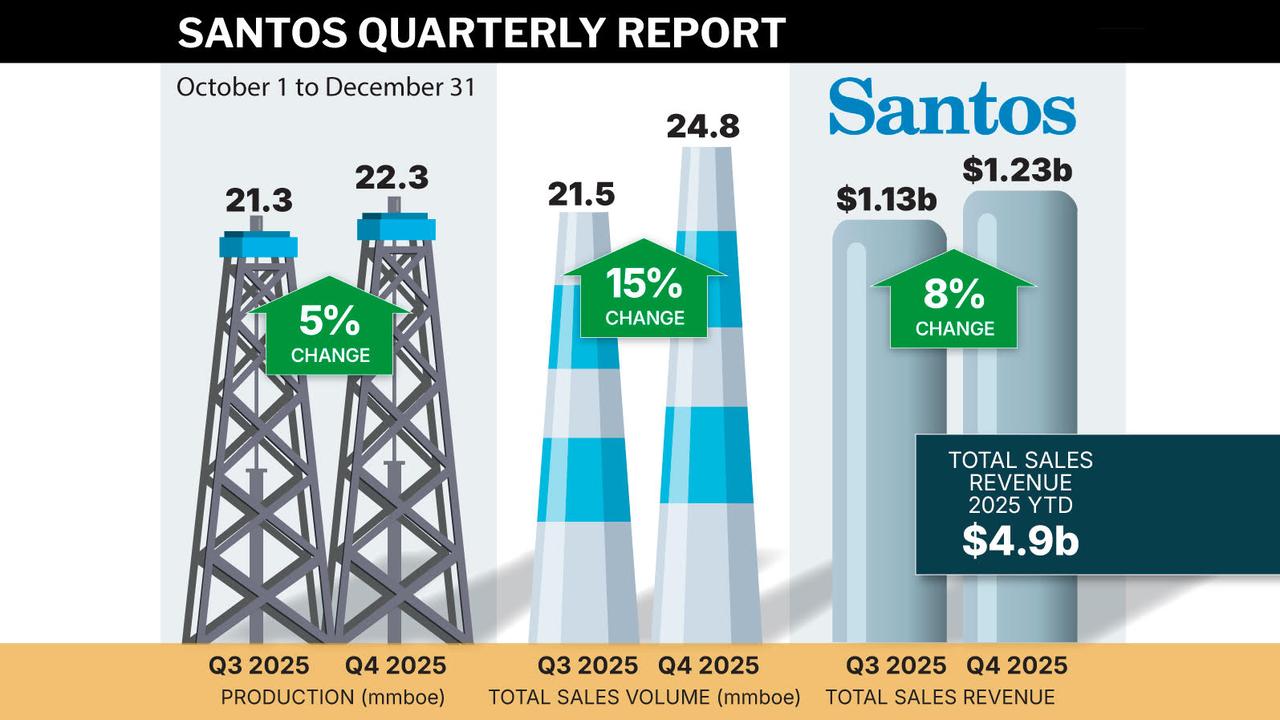

The oil and gas explorer produced 22.3 million barrels of oil equivalent in the three months to December, up five per cent on the prior quarter, with full-year production of 87.7 million barrels.

Sales revenue was up nine per cent on the September quarter to more than $1.2 billion, taking full-year sales revenue to more than $4.9 billion despite tough trading conditions, boss Kevin Gallagher said.

The revenue uplift was driven mostly by higher LNG and condensate sales volumes, but partly offset by lower average realised prices across the portfolio, partly due to a milder-than-average European winter.

“The fourth quarter lifted free cash flow for the full year to approximately $1.8 billion, a strong result in a year of relatively soft commodity prices for the industry, which demonstrates the value of our focus on margin in our marketing and trading activities,” Mr Gallagher said.

The future was also looking bright as Santos moved towards first production at its Tikka project in Alaska and as the first LNG cargo from its Barossa project was loaded in Darwin.

Connection failures had delayed Barossa’s planned ramp-up by two months, due to a campaign to shore up similar connections along the Floating Production, Storage and Offloading system.

“We have taken a very considered approach to the final stages of commissioning to ensure offshore operations achieve a steady state, high level of reliability as quickly as possible once full production is achieved,” Mr Gallagher said.

“Our focus is now on safely and reliably increasing Barossa gas production to deliver long-term value for shareholders in line with our FID (financial investment decision) promise.”

Tikka and Barossa, in their first phases, are tipped to boost Santos’s production by about 25 to 30 per cent by 2027 compared to 2024 levels.

Investors responded warmly to the report, buying up Santos shares and sending them more than four per cent higher to $6.36 by 2pm AEDT on Thursday.

The outlook for gas prices in 2026 and 2027 remains positive, with demand expected to pick up due to data centre growth and the energy transition.

Santos will officially announce its full-year results on February 18.