By the end of January Australians should have a clearer picture of whether they can expect interest rate hikes next year.

Quarterly inflation data, due to be released by the Australian Bureau of Statistics on January 28, will confirm or allay Reserve Bank fears that upward price pressures are entrenched in the economy.

Minutes from the RBA’s last rates-setting meeting, released on Tuesday, reflected the central bank board’s anxiety that inflationary pressures were broadening into more permanent factors, said NAB chief economist Sally Auld.

The December meeting marked a notable hawkish shift from the bank.

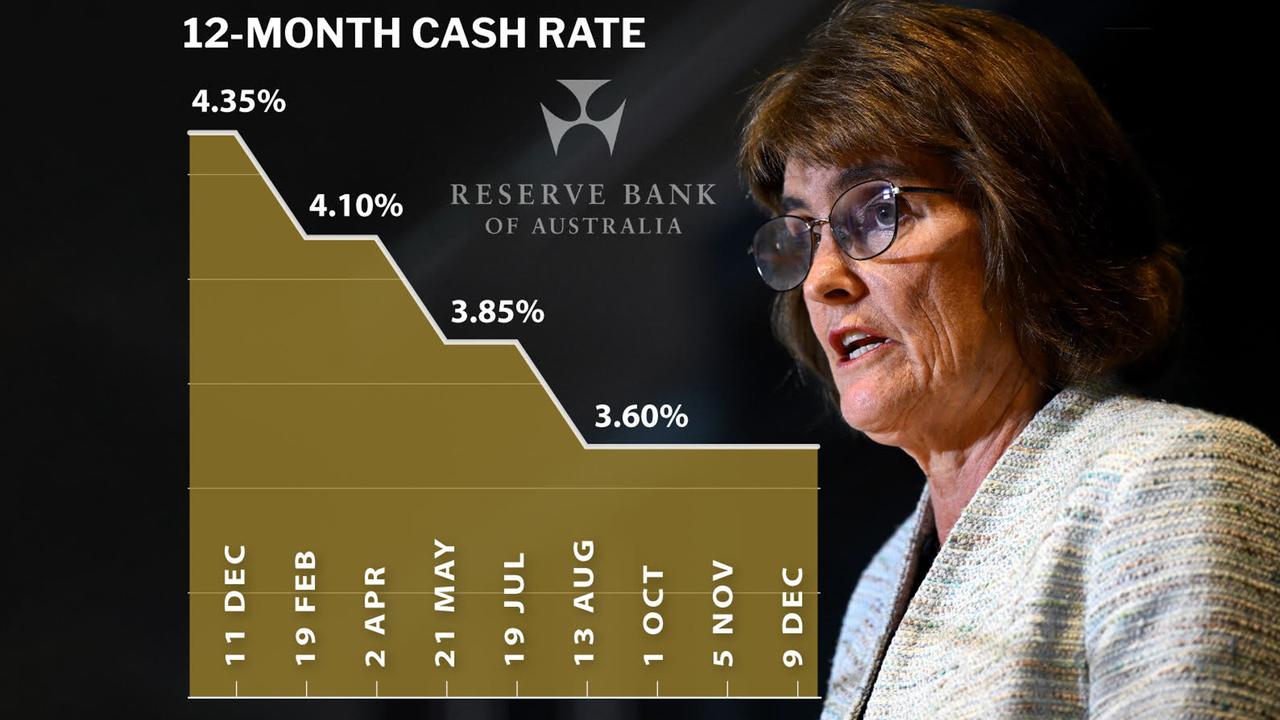

Governor Michele Bullock said in her post-meeting press conference that, while the board did not explicitly consider the case for a rate hike, they did discuss under what circumstances rates would need to rise in 2026.

In fact, two things would need to occur to avert rate hikes, the minutes showed.

Firstly, inflation data would have to show that the recent pick-up in price growth was down to volatile or temporary factors, rather than stickier items such as market services and new dwellings.

Both have grown faster than expected in recent months.

Secondly, the RBA would have to be convinced that financial conditions were still restrictive and therefore putting downward pressure on inflation.

The board judged it was still too hard to tell, with some members arguing that an acceleration in home prices, low risk premiums and aggressive banking competition showed that conditions were no longer restrictive.

Others said the gradual rise in unemployment in 2025 showed conditions were still restrictive.

Whether that debate will be resolved by the next meeting in February remains to be seen.

Markets are pricing in about a quarter to one-third chance of a hike in February.

Given the RBA’s hawkish comments earlier in December, the reaction from traders was muted on Tuesday.

Ms Auld said NAB’s estimate of a 0.9 per cent rise in the RBA’s preferred measure of underlying inflation in the December quarter would make it difficult for the board to resist a hike.

But JP Morgan analyst Tom Kennedy believed underlying inflation was tracking at 0.8 per cent for the quarter, not clearly challenging the bank’s forecasts.

“We retain our view for the RBA to remain sidelined in 2026,” he said.