Australia’s oldest bank has copped criticism for backing away from commitments made under its previous leadership to stop lending to customers involved in deforestation or fossil fuel extraction.

The deforestation policy, proposed under past CEO Peter King two years ago, would have required agricultural borrowers to commit to not converting natural forests for farming purposes from December 31.

“Customer feedback has been clear,” new CEO Anthony Miller told the bank’s annual general meeting in Sydney on Thursday.

“They need more help in navigating existing regulations and demands, rather than dealing with additional bank requirements.”

Mr Miller said customers “and the entire ecosystem in which they operate made it very clear to us that this was of no value”.

“When we speak to our customers, they are exceptional in how they go about managing their land and making sure their farming property is sustainable and is constantly being improved.”

Australia already had a host of legislation and regulations impacting what people could and couldn’t do with their land, he noted.

Australian Conservation Foundation corporate campaigner Jonathan Moylan said the idea deforestation commitments provided “no value” ignored the immense benefits forests provided for food systems, ecosystem and the economy.

“Westpac’s comments today cast doubt on what action the bank will take when habitat is threatened beyond compliance with the law, a bare minimum expectation of any company in Australia,” Mr Moylan told AAP.

Westpac also recently backed away from a pledge it made three-and-a-half years ago – that from October 2025 it would no longer finance upstream oil and gas companies that lacked credible climate transition plans.

“Here we are at the end of 2025 and rather than delivering on this critically important commitment, Westpac has instead opted to put itself in a position to continue funding companies expanding fossil fuels indefinitely,” Kyle Robertson from activist group Market Forces told the meeting.

“Banks like Westpac are enabling a handful of companies to trigger catastrophic and irreversible climate collapse.”

Westpac was the largest lender in Australia to the renewable energy sector and its exposure to the fossil fuel sector was small, at 0.6 per cent, chair Steven Gregg said.

Its exposure to upstream oil and gas extraction fell 10 per cent in 2024/25 and now represents just 0.1 per cent of Westpac’s total exposure.

There was no corporate lending to thermal coal mining customers on its books.

All of its customers in the fossil fuel industry had to have a climate transition plan, Mr Gregg added.

“It’s naïve to think that they’re going to be able to change in a short period of time or they’re going to get out of their business altogether, and we’re going to influence that,” he said.

“But they’ve got to, for us, have disclosures. You’ve got to have an ambition to reduce (emissions), and they’ve got to have a plan that we can look at.”

Market Forces senior banks analyst Morgan Pickett replied that ambition was an empty word in that context.

“I can have an ambition to stop smoking by 2050, but smoke enormous amounts of cigarettes before that time, and you’re going to continue to support that,” he said.

However, shareholders resoundingly rejected a two-pronged resolution backed by Market Forces that would have required Westpac to prove how its fossil fuel financing aligned with global climate goals.

The resolution received 14 per cent of the vote, with 85.7 per cent against, according to a preliminary tally.

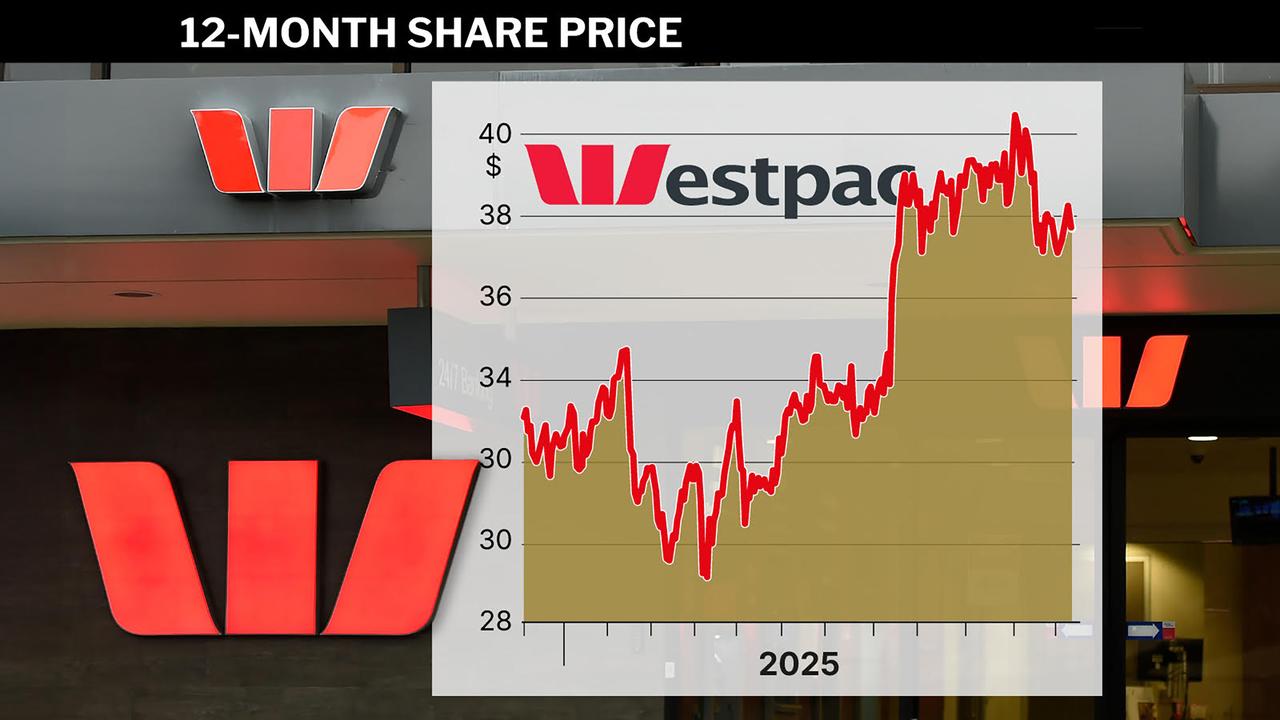

Westpac shares were trading at $38.20 as the market headed to the close, up 1.17 per cent.