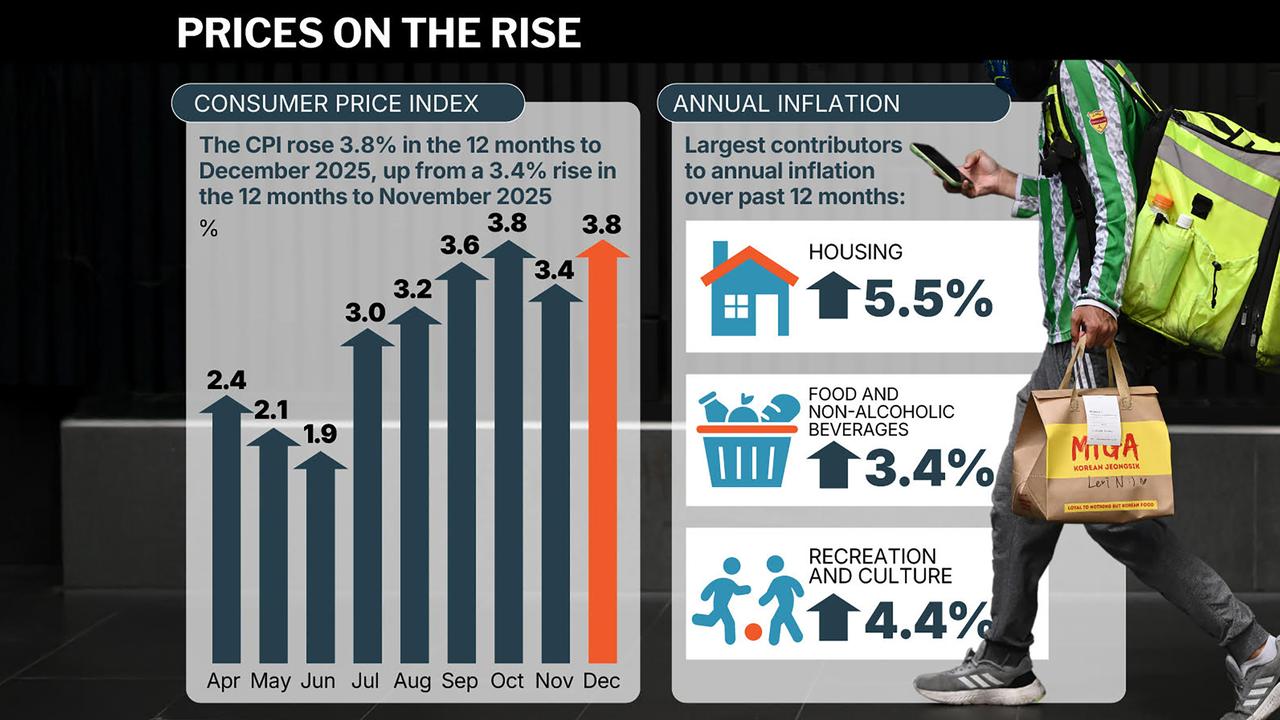

The year’s first round of inflation figures will provide a clearer picture on whether the Reserve Bank’s recent hike to the cash rate was a one-off or a sign of further increases to come.

Wednesday will see the release of inflation data for January, the first set since the Reserve Bank chose to hike interest rates to 3.85 per cent at the start of February.

Headline inflation is expected to stay largely at the same levels of 3.8 per cent, although economists from the Commonwealth Bank have tipped a slight reduction to 3.7 per cent.

The trimmed mean inflation, where volatile items are removed, is expected to remain unchanged at 3.3 per cent.

The measure is still above the Reserve Bank’s target band of between two and three per cent.

January’s data will coincide with the last of the energy rebates coming to an end, which will cause a bump in inflation.

But NAB senior economist Taylor Nugent said the end of power bill relief would not mean a large overall increase.

“We expect that to be offset in January by softer fuel and travel inflation, and from policy changes weighing down a little on health and childcare inflation,” he said.

But even with inflation remaining steady, economists are still tipping further interest rate hikes with the Commonwealth Bank and NAB both tipping an increase to 4.1 per at the Reserve Bank’s board meeting in May.

This week will also see the release of capital expenditure figures, with a 0.7 per cent quarter-on-quarter growth in new investment likely to be confirmed on Thursday.

Wall Street investors are meanwhile expecting strong investment growth in information media and telecommunications industries after the US Supreme Court struck down President Donald Trump’s global tariffs.

The court, which has a conservative majority, ruled 6-3 against Trump’s global tariffs, under a federal law meant for national emergencies.

The S&P 500 climbed 0.69 per cent to end Friday at 6,909.51 points.

The Nasdaq gained 0.90 per cent to 22,886.07 points, while the Dow Jones Industrial Average rose 0.47 per cent to 49,625.97 points.

Australian share futures crept up 16 points, or 0.17 per cent, to 11,293.

The S&P/ASX200 shaved 4.8 points, down 0.05 per cent to 9,081.4, on Friday as the broader All Ordinaries gave up 13.4 points, or 0.14 per cent, to 9,303.2.