Australia’s largest steel maker is back in a takeover play after its predators upped an offer to buy the group.

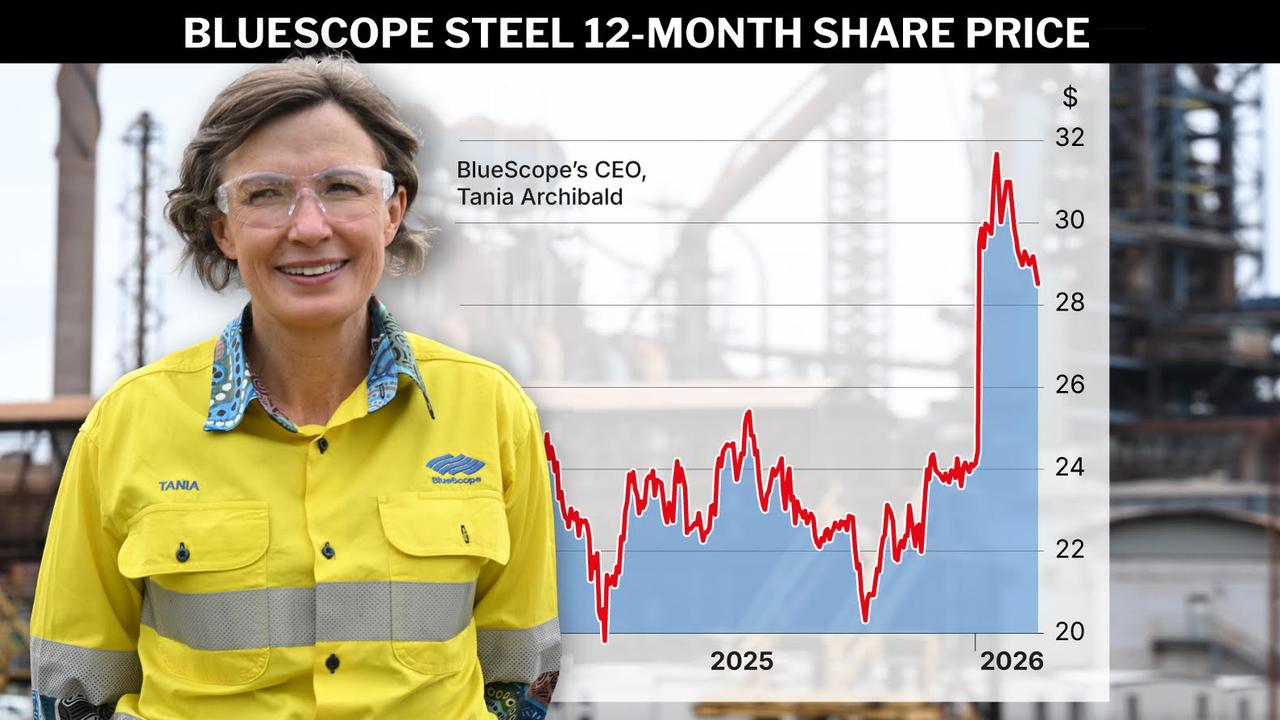

The Stokes family-controlled SGH and its US bid partner Steel Dynamics on Wednesday put a “best and final” $32.35 per share offer to BlueScope shareholders on the table, valuing the company at about $15 billion.

That compares to their $30-per-share proposal revealed in January, which was rejected by the target as undervaluing its assets and potential.

BlueScope soon after announced it would hand back $438 million to shareholders.

Earlier in the week, chief executive Tania Archibald told investors at a results briefing that the company intended to lift its shareholder distribution target to return 75 per cent of free cash flow, up from its previous target of 50 per cent.

The Port Kembla steelworks owner on Monday posted a first-half net profit for 2025/26 of $390.8 million, up 118 per cent from the same time a year ago.

SGH and Steel Dynamics said their revised offer presented an attractive premium for BlueScope shareholders.

“The increased purchase price represents SGH and SDI’s best and final offer in the absence of a superior competing proposal for all or a material part of BSL,” they said in a statement.

The pair still plan to split BlueScope, with SGH keeping its Australian and other regional operations and on-selling the North American operations to Steel Dynamics.

In addition to the Port Kembla steelworks in southern NSW, BlueScope has the North Star operation in the US state of Ohio, which uses scrap to produce hot-rolled steel at low cost.

Shares in BlueScope, which is yet to formally respond to the new offer, ended at $28 on Tuesday.