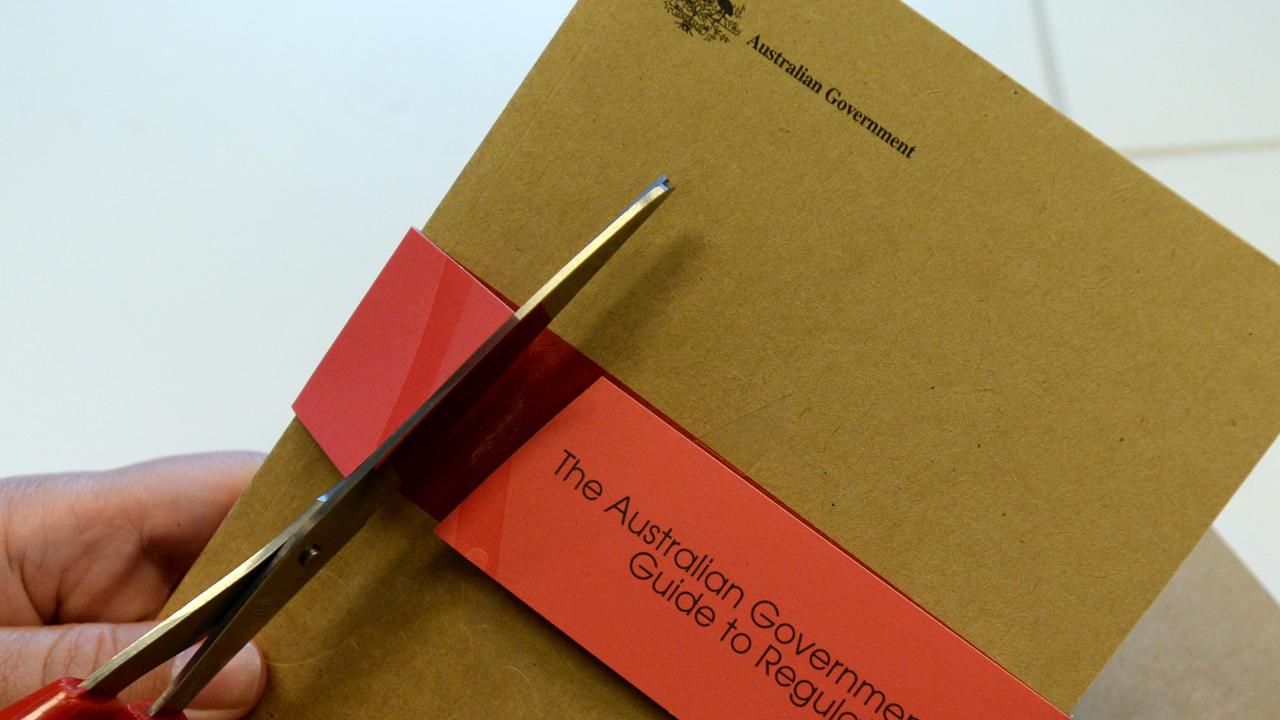

Red tape in Australia has gotten so thick, compliance has become a major industry in its own right.

In 2024, businesses employed 52,000 dedicated workers just to comply with regulation, a report released by the Australian Institute of Company Directors on Monday claims.

That’s more staff than are employed by the entire coal mining sector – Australia’s second-largest export industry.

The paper, written by economics consultancy Mandala Partners, estimates the thickets of federal red tape, that have grown like topsy in the past decade, are costing Australian businesses and the economy $160 billion, or 5.8 per cent of GDP.

That’s up from 4.2 per cent of GDP in 2013, when the last economy-wide regulatory stocktake was compiled.

The analysis lays out the scope of the challenge facing Treasurer Jim Chalmers, as he attempts to boost productivity and cut unnecessary red tape in the economy.

Australia has become a hard place to do business and, without change, would lose its international competitiveness, warned AICD chief executive Mark Rigotti.

The amount of pages of federal regulation has tripled since 2000, while the time boards spend on complying with red tape has grown from 23 to 55 per cent in the past 10 years, the report found.

“This isn’t about weakening protections or cutting corners. It’s about making our regulatory system fit for purpose,” Mr Rigotti said.

“When more than half of board time is consumed by compliance and regulatory oversight, we know we have got the balance wrong.”

The issue is not the fact that governments seek to regulate risky or destructive activities, but in the unwieldy way that laws have been layered on top of one another over time.

In a report earlier this year, independent advisory body the Productivity Commission found poorly conceived individual regulations or a “pile-up” of multiple regulations hindered business investment and dynamism.

That has contributed to Australia’s productivity growth – the main determiner of rising living standards in the long run – sinking to its lowest level in more than 60 years.

Dr Chalmers said he was determined to make in-roads on the blockages.

“Whether it’s slashing tariffs, streamlining and strengthening our foreign investment regime, our merger reforms, or our environmental reforms in the Parliament this week, we’re doing a lot to responsibly improve regulation and speed up approvals,” he said.

“We’ve already got a big agenda to ease the burden on businesses, cut red tape and build more homes but we’re keen to do more where we can.”

The institute called on the treasurer to reduce the regulatory burden by a quarter by 2030 and implement a process to better assess the impacts of new pieces of regulation on compliance costs.

Other recommendations in the report included lifting the threshold at which companies are required to lodge audited financial reports with the corporate regulator from $50 million in revenue and $25 million in assets to $100 million in revenue and $50 million in assets.

According to the report, that alone would yield around $1.7bn in compliance savings over four years, whilst removing the climate reporting burden for around 1500 firms.

“We must abandon a set and forget approach that allows regulatory accumulation by default,” Mr Rigotti said.