A company tied to mining lobbyists and unions collected billions in levies on behalf of the government Stephanie Tran investigates.

Between 1993 and 2017, an obscure private company run by the CFMEU, NSW Minerals Council and Queensland Resources Council was effectively collecting Commonwealth taxes. The billion-dollar Commonwealth scheme was meant to end decades ago, but it is still going.

As the Administrator of the Coal Long Service Leave Corporation (Coal LSL), Auscoal Services (now known as Team Super Services) was handed powers usually reserved for the Australian Taxation Office: setting a payroll levy rate, collecting contributions from employers, and distributing billions of dollars.

For nearly a quarter of a century, this little-known arrangement saw a private company exercise one of the Commonwealth’s most fundamental sovereign powers, the power to appropriate and collect taxes.

How the scheme began

The Coal Mining Industry (Long Service Leave Funding) Act 1992 was introduced to address a looming $250 million liability in unfunded long service leave entitlements. A temporary fix, the scheme was meant to operate for about a decade until the liability was paid down.

The explanatory memorandum of the Bill made the government’s intent explicit:

“It is intended that when the accrued liability is fully funded, the scheme will be wound up and responsibility for provision of long service leave entitlements will be returned to the industry.”

To administer the scheme, the Commonwealth created a board dominated by industry interests: representatives of the NSW Minerals Council, the Queensland Resources Council, and the CFMEU.

But instead of winding up after 10 years, the scheme grew. And it grew under private control.

Outsourcing the government’s job

Rather than directly administering the fund, the board outsourced all operations to a company they controlled, Auscoal Services. During the period when Auscoal Services ran Coal LSL, the shareholders of the company were the CFMEU, NSW Mineral Council and Queensland Resources Council.

Auscoal set the levy rates, collected compulsory contributions from employers on behalf of the federal government, invested the money, and reimbursed employers for leave payments. It also had the power to decide its own fees.

When asked by a Senate committee to produce contracts governing this arrangement, Coal LSL managed to find only three covering a 25-year period. When questioned, CEO Darlene Perks stated that the corporation had “exhausted our resources”. Perks admitted that between 1993 and 2017, Coal LSL itself had zero employees. The entire operation was run out of Auscoal.

Effectively, this meant that for 25 years, a private company exercised the “taxing power” under section 51 of the Constitution, a power regarded as one of the most fundamental responsibilities of government.

A billion-dollar industry fund

The scheme was lucrative. Contributions to the fund were made tax-deductible, a benefit originally justified in Parliament as a way to soften the blow of new levies. As one minister put it during the second reading: “In view of the potential cost impact of the new arrangements on sections of the industry, particularly the requirement to achieve full funding, it is appropriate that the tax treatment of levy contributions to the new scheme should be as favourable as the tax treatment of payments under the current excise funding arrangements. As excise payments are deductible for company income tax purposes, it is anticipated that there will be no additional cost to revenue.”

Long service leave payments made by coal industry employers remain tax deductible to this day.

Over time, the fund swelled to billions of dollars under management.

The employers, unions, and lobby groups sitting on its board oversaw not only its collection but its investment.

Black Hole: CFMEU, governments, BHP, black coal giants in $2.5B worker wage swindle

A legal grey zone

The scheme’s unusual nature soon attracted legal scrutiny.

In 1998, Coal LSL brought a case against the Commissioner of Taxation arguing that it was exempt from income tax as it was a “public authority”. As Coal LSL had no employees, the case was run by Auscoal Services. Essentially, a private company representing the interests on the coal industry ran a case against the Australian Tax Office to avoid paying tax.

Federal Court Justice Emmett concluded that Coal LSL was not a “public authority” and therefore should not be exempt from paying income tax. His judgment noted:

“The current scheme is unusual insofar as it involves the use of the taxing power of the Commonwealth in order to achieve an aim which has nothing to do with the raising of money for Commonwealth purposes.”

“The tax gathering function of the Corporation is not for the purpose of raising revenue, and the Fund is operated and administered under the direction and at the cost of the employers.”

The Corporation is not performing a function in the interests of the public generally, but in the interests of the employers in the coal mining industry.

Judge Emmett emphasised the “lack of control of the Corporation by government and its lack of answerability to government” and that “[Coal LSL] is not controlled by the Minister and there are significant areas of discretionary conduct left to the board of the Corporation.”

But in 1999, the decision was overturned on appeal. Coal LSL was deemed a “public authority” and granted income tax exemption – even though it had no employees and was wholly operated by Auscoal Services.

The decision to insource

After almost 25 years of outsourcing every aspect of its operations to Auscoal, Coal LSL abruptly changed course in 2017.

In its 2016–17 financial report, the corporation disclosed that the board had decided “not to renew our administration contract when it expired on 30 June 2017” and instead bring all functions in-house. The decision, taken in October 2016, marked the end of Auscoal’s direct control.

From 1 July 2017, Coal LSL began operating as a stand-alone entity. For the first time in its history, it had employees of its own. The 2017–18 financial report described the shift as “transforming our business model from a 25-year old system to an agile and fully insourced operation.”

The timing raises questions. Why did the board finally decide to insource after a quarter century of total reliance on a private contractor?

When asked why the change was made, Coal LSL provided only a limited explanation:

“Section 8 (2) of the Coal Mining Industry (Long Service Leave Funding) Administration Act 1992 says ‘the power of the Corporation to enter into contracts includes the power to enter into a contract with a person under which that person will administer the Fund on behalf of the Board.’ The administration function of the Corporation was outsourced for several years, in line with Section 8(2) of the Administration Act. Similarly, the decision to ‘not outsource’ the administration function was made by the Corporation’s Accountable Authority in 2016 and was effective in 2017.”

The response offers little insight into why the outsourcing arrangement, which had defined Coal LSL for nearly a quarter of a century, was finally abandoned.

Risks flagged, then ignored

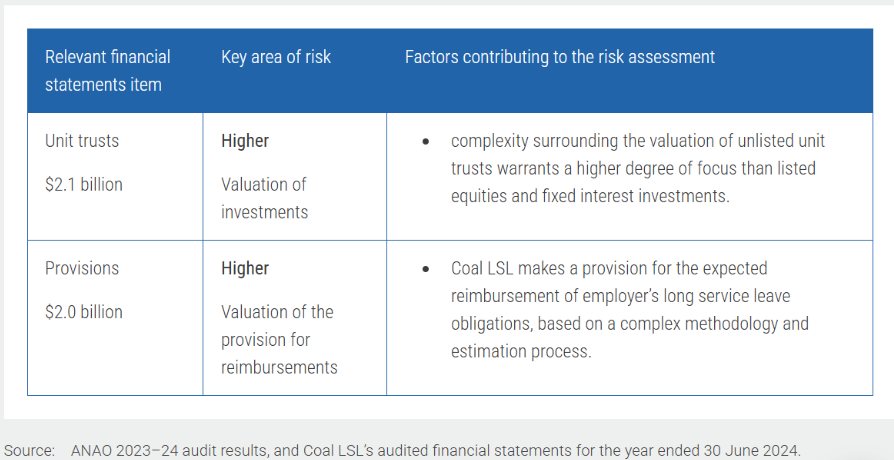

Audits by the Australian National Audit Office have repeatedly warned of the risks posed by Coal LSL’s opaque operations. The most recent 2025 report again flagged “higher” risk regarding the valuation of investments and the reimbursement of funds, assessments virtually identical to those issued over the past decade.

Despite the red flags, little has changed in how the fund is administered.

The government’s response

MWM put detailed questions to the Department of Employment and Workplace Relations (DEWR), seeking clarity on three central issues:

- Why successive governments allowed a private company to exercise the Commonwealth’s taxing power for 25 years,

- What prompted the 2017 decision to bring Coal LSL’s operations back in-house, and,

- Why the scheme, originally intended as a temporary fix, has not been wound up more than three decades later.

The department did not provide an explanation for any of these issues. DEWR provided the following response, declining to answer why successive governments allowed a private company to control a multibillion-dollar Commonwealth fund for almost a quarter of a century.

“The government monitors the functioning of the Coal Mining Industry (Long Service Leave Funding) Scheme. The relevant provisions of the Coal Mining Industry (Long Service Leave) Administration Act 1992 are triggered by a report from the Coal LSL Board to the Minister for Employment and Workplace Relations. Issuing such a report is a matter for Coal LSL. Questions about contracts or agreements entered into by Coal LSL should be directed to Coal LSL.”

Dirty Rainbow: Govt picks up legal bills for TerraCom directors in coal fraud saga